EV Supply Chain > Traction Motors & Magnets

Traction Motors & Magnets

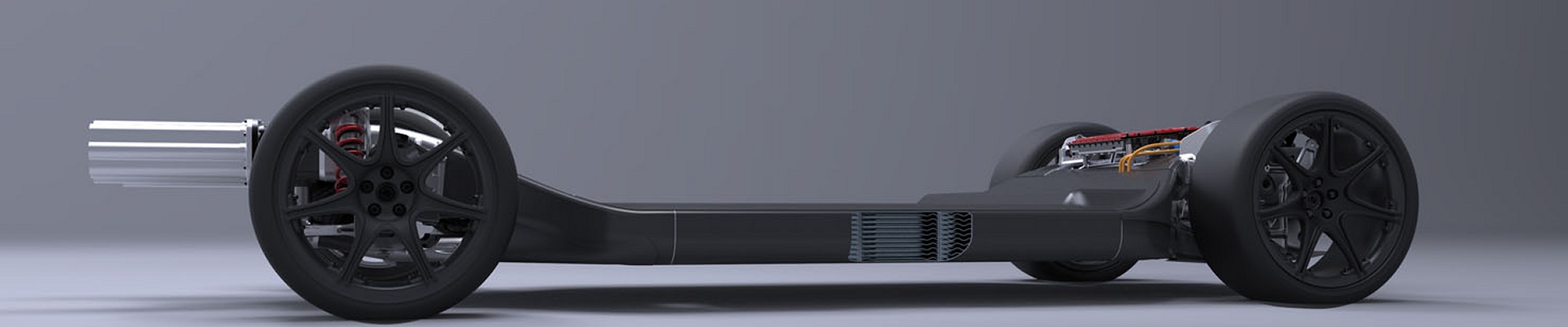

Electric vehicle (EV) traction motors convert electrical energy into mechanical torque to power the drivetrain. They are the core of EV propulsion, with design choices—motor type, materials, and manufacturing processes—directly shaping efficiency, cost, performance, and sustainability. This page catalogs EV motor technologies and their supply chains, including critical subcomponents such as magnets and electrical steel cores.

Motor Types

Automakers deploy different motor architectures based on tradeoffs in torque density, efficiency, and cost. Each type has unique implications for raw materials, manufacturing complexity, and performance tuning.

| Motor Type | Examples | Key Advantages | Constraints |

|---|---|---|---|

| Permanent Magnet Synchronous Motor (PMSM) | Tesla Model 3 rear motor, BYD e-platform | High efficiency, high power density | Relies on rare-earth magnets; supply chain risk |

| Induction Motor (IM) | Tesla Model S/X front motor, Jaguar I-PACE | No rare earths; proven design; robust | Lower efficiency vs PMSM; heavier |

| Switched Reluctance Motor (SRM) | Commercial/industrial prototypes | No magnets; simple rotor; high reliability | Noise/vibration; complex control |

| Axial Flux Motor | YASA (Mercedes EQXX), startups like Magnax | High torque density; compact size | Manufacturing complexity; early stage scaling |

Magnets

Magnets are critical for permanent magnet motors, delivering high efficiency and compact form factors. Most rely on rare-earth elements such as neodymium, dysprosium, and terbium. Supply chain risks are significant, as rare earth mining and refining are concentrated in China, driving automakers to explore alternatives and recycling pathways.

China is the largest producer of rare earth elements, accounting for over 80% of global production. This concentration of production creates a significant challenge for sourcing and supply chain management, particularly for companies that are reliant on these materials. To address this challenge, some companies are exploring alternative magnet materials that do not require rare earth elements. Tesla has developed an induction motor for use in its Model 3 and Model Y vehicles that does not require rare earth elements.

| Magnet Type | Materials | Advantages | Constraints |

|---|---|---|---|

| NdFeB (Neodymium-Iron-Boron) | Neodymium, iron, boron, dysprosium | Highest performance; widely adopted | High cost; geopolitical supply risks |

| Ferrite Magnets | Iron oxide, strontium carbonate | Low cost; no rare earths | Lower efficiency; heavier motor designs |

| Rare-Earth-Free Alternatives | Advanced alloys, composites | Reduce dependence on critical minerals | Mostly in R&D; limited commercial scale |

Motor Cores

Motor cores are made of laminated electrical steels that guide magnetic flux. Their design affects motor efficiency, noise, and heat management. High-quality cores rely on specialized materials such as grain-oriented electrical steel (GOES) and non-grain-oriented steel (NGO), both of which face supply chain bottlenecks.

| Core Type | Material | Advantages | Constraints |

|---|---|---|---|

| Non-Grain-Oriented Electrical Steel (NGO) | Silicon steel, low-loss laminations | Standard for traction motors; balanced performance | Higher energy loss than GOES; supply tightness |

| Grain-Oriented Electrical Steel (GOES) | Silicon steel with aligned grains | Superior magnetic efficiency; reduces core losses | Limited supply capacity; production concentrated |

| Amorphous/Advanced Steels | Nanocrystalline or amorphous alloys | Ultra-low core losses; future-ready | Still in R&D; high cost |

Supply Chain Risks

Both permanent magnets and motor cores depend on specialized materials with highly concentrated supply chains. Rare earth elements (Nd, Dy, Tb, Pr) and electrical steels (NGO/GOES) face similar risks in terms of geographic concentration, price volatility, and environmental constraints. Automakers are pursuing multiple strategies to mitigate these bottlenecks.

| Risk Factor | Impact | Mitigation Strategies |

|---|---|---|

| Geographic Concentration | China controls 80%+ of rare earth refining; electrical steel production limited to a handful of mills in Asia/EU | Regional diversification; new mining/refining projects (US, EU, Australia); long-term offtake contracts with mills |

| Price Volatility | Rare earth and electrical steel prices spike with supply shocks, increasing EV motor costs | Vertical integration by automakers; hedging and long-term supply agreements |

| Environmental & Social Costs | Rare earth mining/refining creates toxic waste; electrical steel production is energy-intensive | Investment in cleaner refining methods; recycling of magnets and scrap steel; low-carbon steel initiatives |

| Capacity Constraints | Global NGO/GOES capacity sized for transformers/grids, not EV scale; rare earth refining expansions lag demand | OEM lobbying for new NGO lines; government subsidies for rare earth processing; R&D into amorphous steels |

| Technology Alternatives | Dependence on critical materials locks OEMs into fragile supply chains | Shift to induction/reluctance motors; ferrite or rare-earth-free magnets; axial flux with reduced material intensity |

EV motors manufacturers

Many of the large EV automakers such as Tesla, GM, and BMW make their own motors in-house. Here is a list of manufacturers that produce traction motors, motor cores, and magnets for other vehicle manufacturers.

U.S. motor manufacturers

| Manufacturer |

|---|

| AC Propulsion |

| Bosch |

| Cascadia Motion |

| Kollmorgen |

| Lynx Motion Technology |

| Magna |

| NetGain Motors |

| Protean Electric |

| Remy International |

| SPAL Automative |

| UQM Technologies |

Global motor manufacturers

Traction drive motors manufactured worldwide excluding China:

| Manufacturer | Country |

|---|---|

| Advanced Electric Machines | UK |

| Asin | Japan |

| Avid Technology | UK |

| Blue Nexus | Japan |

| Bosch | Germany |

| Brighsun New Energy | Austria |

| BRUSA Elektronik | Switzerland |

| Buhler Motor | Germany |

| Compact Dynamics | Germany |

| Conti Temic Microelectronic | Germany |

| Continental | Germany |

| Coreless Motor | Japan |

| Dana | Canada |

| Delta Electronics | Taiwan |

| Delta Electronics | Japan |

| EV Motor Systems | Japan |

| Fukuta | Taiwan |

| HEINZMANN | Germany |

| Higen Motor | Korea |

| Hitachi | Japan |

| Hyosung | Korea |

| Hyundai Mobis | Korea |

| Kamtec | Korea |

| Kolektor Magnet | Germany |

| LG Electronics | Korea |

| Magna | Canada |

| Meidensha | Japan |

| Mitsuba | Japan |

| Mitsubishi Heavy Industries | Japan |

| New Favor Industry | Taiwan |

| Nidec PSA Emotors | Japan |

| Nidec PSA Emotors | France |

| NTN | Japan |

| ORBIST Powertrain | Austria |

| Ovalo | Germany |

| Power Plaza | Korea |

| Sawafuji Electric | Japan |

| Schwarz Elektromotoren | Germany |

| SEA Electric | Austria |

| Sinfonia Technology | Japan |

| SNT Motiv | Korea |

| SolarEdge e-Mobility | Italy |

| Stoba e-Systems | Germany |

| Tamagawa Seiki | Japan |

| TECO Electric | Taiwan |

| TOP | Japan |

| Toshiba | Japan |

| Tsuzuki | Japan |

| Valeo Siemens | Germany |

| XASOS Motors | Korea |

| YASA Motors | UK |

| YASKAWA Electric | Japan |

EV motor cores

| Manufacturer | Country |

|---|---|

| Euro Group | Italy |

| Kienle Spiess | Germany |

| Mitsui High-tec | Japan |

| POSCO | Korea |

| Sumitomo Bakelite | Japan |

| Tempel Steel | USA |

| Toyota Boshoku | Japan |

| Yutaka Giken | Japan |

EV motor magnets

| Manufacturer | Country |

|---|---|

| Achi Steel | Japan |

| Daido Steel/Electronics | Japan |

| DIC | Korea |

| Hitachi Metals | Japan |

| Kolektor Magnet | Germany |

| MAGPROST | Japan |

| MATE | Japan |

| Nitto Denko | Japan |

| Sagami Chemical Metal | Japan |

| San-S Industry | Japan |

| Shin-Etsu Chemical | Japan |

| TDK-Lambda | Japan |