EV Onboard Chargers (OBC)

On-board chargers (OBC) convert AC power from Level 1 and Level 2 EVSE into DC suitable for battery charging and support the vehicle's low-voltage systems. While DC fast charging bypasses the OBC, Level 2 charging still dominates residential and workplace charging, making OBCs a critical, high-volume component in the EV supply chain.

This page covers the component stack, OEM and Tier-1 suppliers, regional footprint, cost structures, technology trends, and major risks for on-board chargers under the HV/LV Electrical supply chain node.

Functional Role in the Vehicle

The OBC performs three essential functions at the vehicle level.

- AC to DC conversion: accepts AC input and converts it to DC through power factor correction and high-frequency conversion stages.

- Voltage and current regulation: manages current into the high-voltage battery and enforces protection limits.

- Low-voltage system interaction: often integrates with the DC-DC converter to support 12 V or 48 V systems and provides isolation and diagnostics.

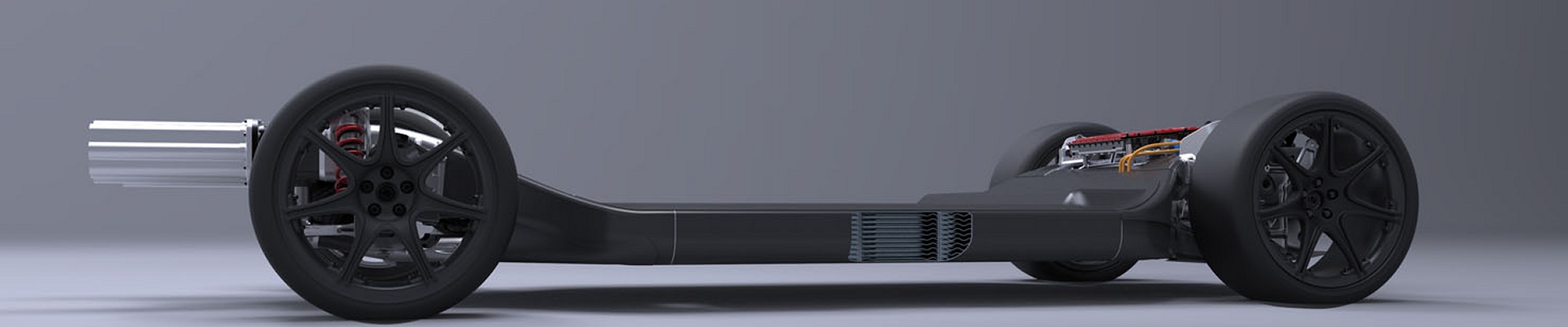

In many architectures, the OBC is combined with DC-DC conversion and sometimes traction inverter stages into a unified power electronics module.

OBC Component Stack

A modern on-board charger contains several key component classes.

Power Semiconductors

- silicon carbide MOSFETs in high-efficiency OBCs

- silicon MOSFETs or IGBTs in cost-optimized designs

- gate driver ICs and synchronous rectification stages

Magnetics

- high-frequency transformers

- inductors for power factor correction and DC-DC stages

- EMI chokes and filters

Capacitors and Passives

- high-temperature film capacitors for energy storage and filtering

- ceramic capacitors for switching and control

- high-voltage relays, connectors, and protection components

Control Electronics

- microcontrollers or domain controllers

- current, voltage, and temperature sensing circuits

- communication interfaces to the battery management system

Mechanical and Thermal Assembly

- heatsinks and thermal plates

- potting, insulation, and isolation barriers

- sealed housings and cooling interfaces

OBC Power Classes and OEM Strategies

OBC ratings vary by segment and region.

| Power Class | Typical Use | Notes |

|---|---|---|

| 3.3 kW | Entry-level or older EVs | Low cost and low power demand, slower charging. |

| 6.6-7.4 kW | Mainstream EV platforms | Common for single-phase residential charging. |

| 11 kW | EU-focused EVs | Three-phase support for faster home and workplace charging. |

| 19-22 kW | Premium EVs and fleets | Higher power for quick turnaround and demanding duty cycles. |

OEM strategies differ:

- vertical integrators combine OBC, DC-DC, and traction inverter into unified power modules and often adopt SiC early.

- many European OEMs favor modular 11 kW OBCs supplied by established Tier-1s.

- Chinese OEMs frequently use domestic suppliers for SiC-based OBCs to meet aggressive efficiency targets.

OBC OEM List

| Manufacturer |

|---|

| BorgWarner |

| Delta Electronics |

| Denso |

| Far East Cable |

| Fischer Automotive |

| Foxconn |

| Hyundai Mobis |

| KIRCHOFF Automotive |

| Lear |

| Leopold Kostal |

| LG Electronics |

| Meta System |

| Mitsubishi Electric |

| Nichicon |

| Panasonic |

| Quanta Computer |

| Valeo Group |

Power Semiconductor Suppliers

SiC and Si devices in OBCs are sourced from a limited number of Tier-2 semiconductor vendors.

- Wolfspeed

- Infineon Technologies

- STMicroelectronics

- ROHM Semiconductor

- Onsemi

- Microchip and IXYS in niche applications

The migration from silicon to silicon carbide is accelerating for 6 to 22 kW OBCs due to efficiency and thermal advantages.

Regional Manufacturing Footprint

Manufacturing of OBCs and subcomponents is distributed across several regions.

- Asia (China, Korea, Taiwan): high volume of magnetics, passives, and assembly of OBC and combined HV units.

- Europe: strong Tier-1 presence, local production for EU-market EVs, and advanced power electronics R&D.

- United States: smaller OBC assembly footprint but growing SiC device fabrication capacity.

This distribution shapes exposure to logistics issues, regional demand shocks, and policy changes.

Capacity and Supply Constraints

The OBC supply chain is exposed to several structural constraints.

- SiC MOSFET availability and wafer capacity, especially during EV demand spikes

- limited global capacity for high-frequency transformers and precision magnetics

- availability of high-voltage film capacitors and EMI filters

- assembly and high-voltage isolation testing throughput at Tier-1 plants

These constraints can extend lead times and force OEMs to adjust power classes or suppliers.

Technology and Market Trends

Several trends are shaping OBC technology and supply dynamics.

- migration from silicon to silicon carbide for higher efficiency and power density

- integration of OBC, DC-DC, and inverter into combined power modules

- increasing adoption of 11 and 22 kW OBCs in markets with three-phase infrastructure

- growth of bidirectional OBCs supporting vehicle-to-load, vehicle-to-home, and vehicle-to-grid functions

- advances in thermal integration and common cooling plates shared with traction inverters

- pressure for standardized OBC designs across platforms to reduce engineering cost

Market Outlook

OBC volumes will scale closely with EV adoption because nearly every EV requires an OBC. Migration to SiC will tighten semiconductor supply but reduce thermal and efficiency constraints at the system level.

Integration into combined power modules will shift sourcing toward major Tier-1 suppliers and vertically integrated OEMs. Bidirectional OBCs are expected to become standard in many markets, increasing BOM complexity but enabling new value streams in Energy Autonomy and grid services.

Geographic diversification of OBC manufacturing is likely as OEMs push for regional supply security and reduced exposure to single-region disruptions.